Roughly, 70%-80% of lenders (estimated) have adopted HEM as a benchmark. The HEM (Household Expenditure Measure) was developed by the Melbourne Institute of Applied Economics in 2011 as a measure that reflects a modest level of weekly household expenditure for various types of families.īanks use this benchmark to estimate a borrower’s annual living expenses. What is the Household Expenditure Measure (HEM)? In 2012, the Commonwealth Bank (CBA) switched to HEM and other banks followed.

Industry regulator, the Australian Prudential Regulation Authority (APRA) doesn’t provide specific dollar figures for banks to adhere to so for years they were using the Henderson Poverty Index or Henderson Poverty Line and added an allowance. Under the National Consumer Credit Protection Act 2009, Australian banks must make allowances for living costs when they run borrowing power or serviceability assessments for applicants. However, Australians tend to have a much higher income so it’s still possible to enjoy a good lifestyle. In particular, you’ll find that the following items are much more expensive: The cost of living in Australia is significantly higher than most countries, including other developed nationas like the UK and the US. You may find that your average cost of living is high due to the cost of bringing goods and services to your community.

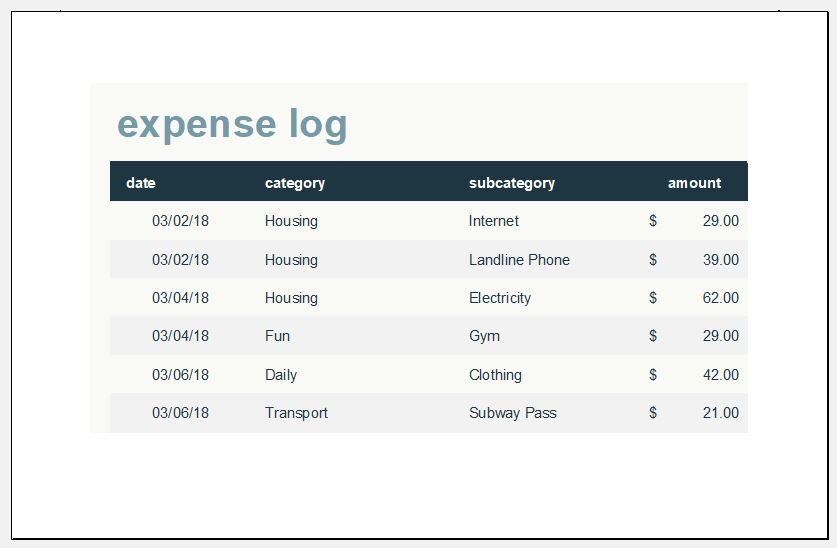

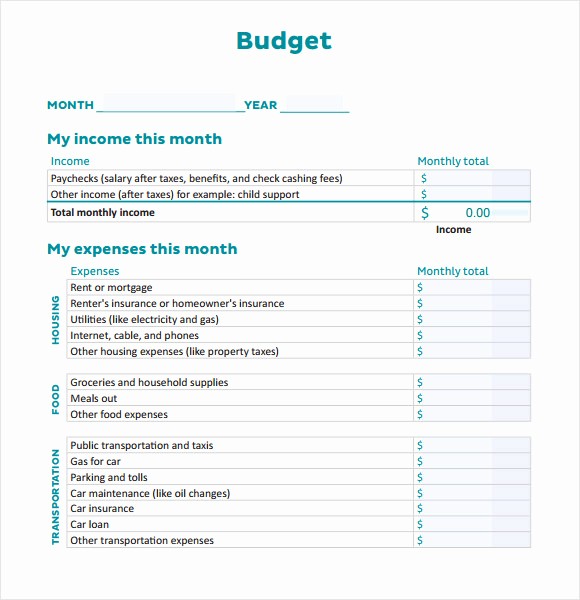

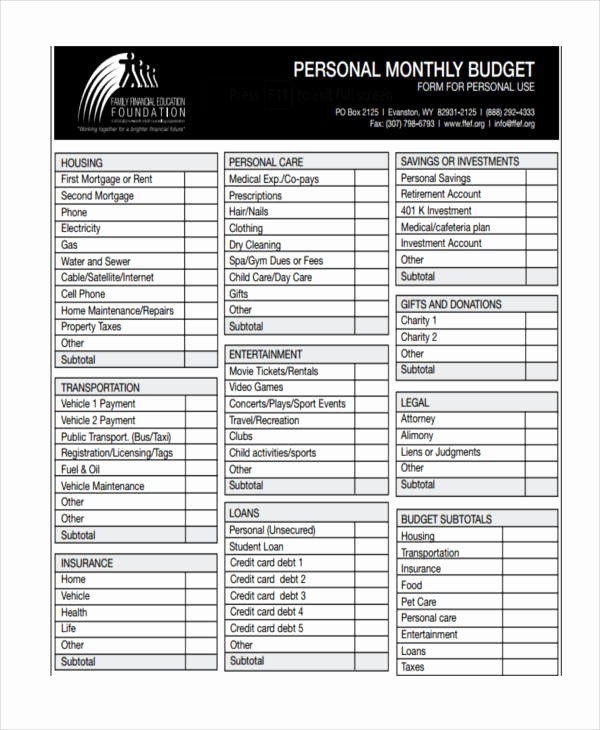

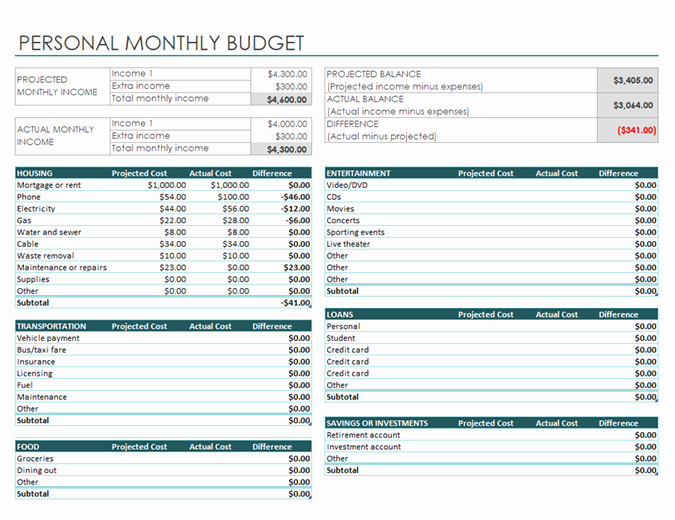

However, it’s people living in the other capital cities such as Brisbane and Adelaide that have some of the lowest living expenses in Australia.Īn exception to this is if you live in a very remote area such as a mining town. The most expensive cities in Australia are Sydney and Melbourne, followed by Perth and Canberra. The cost of renting or mortgage repayments is calculated separately so you can replace the figure with your own estimate after you decide where you’d like to live. The calculator takes all basic living expenses into account such as groceries, utilities, phone, public transport/car and entertainment. In some cases, it may be a matter of setting a 3-6 month plan of budgeting and cutting out necessary spending.Ĭheck out our prepare to buy program if you’re not quite ready for a home loan. It’s best to speak with a mortgage broker to discover whether there are lending options available to you. The calculator result should act as a general guide only as your living expenses can vary significantly depending on how you choose to spend your money. You’ll still need to self-assess, but the calculator will give you a reasonably accurate indication of how your spending compares to the average monthly cost of living in Australia. How will the living expenses calculator help me?īorrowers are required to manually work out their living expenses on a weekly or monthly basis when they complete their home loan application.

When banks assess your ability to borrow, one of the major factors they evaluate is your spending compared to income. Your details Why do banks care about my living expenses?

0 kommentar(er)

0 kommentar(er)